Paul B Insurance Medigap Can Be Fun For Anyone

Insurance policy that is purchased by a private for single-person coverage or insurance coverage of a family members. The specific pays the costs, instead of employer-based health insurance policy where the employer usually pays a share of the premium. Individuals may buy and acquisition insurance coverage from any kind of plans offered in the person's geographic area.

Individuals and also families may certify for financial assistance to lower the expense of insurance policy costs and also out-of-pocket costs, but only when signing up with Connect for Health And Wellness Colorado. If you experience certain changes in your life,, you are eligible for a 60-day duration of time where you can register in a private plan, also if it is outside of the yearly open enrollment duration of Nov.

Little Known Facts About Paul B Insurance Medigap.

15.

Anyone age 65 or older certifies for Medicare, which is a federal program that offers affordable medical care coverage. There are some significant distinctions between Medicare as well as exclusive insurance policy strategy options, insurance coverage, prices, as well as more.

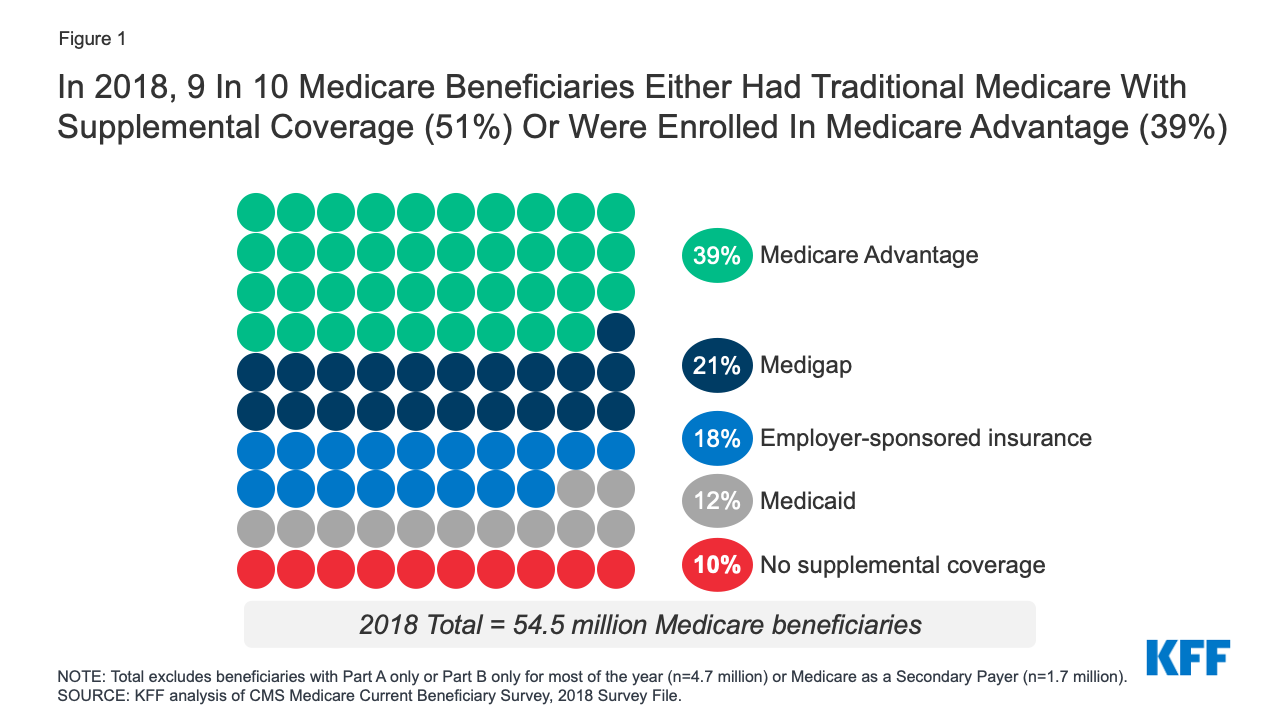

Medicare Benefit (Part C), Component D, as well as Medigap are all optional Medicare plans that are marketed by exclusive insurance policy business. Medicare Advantage plans are a preferred option for Medicare beneficiaries since they offer all-in-one Medicare coverage - paul b insurance medigap. This consists of original Medicare, as well as the majority of plans also cover prescription medications, oral, vision, hearing, and also other health and wellness advantages.

The distinctions between Medicare and personal insurance coverage are a substantial consider choosing what sort of strategy may work best for you. When you enlist in Medicare, there are 2 almosts all that compose your protection: There are numerous choices for buying personal insurance policy. Lots of people acquisition private insurance through their employer, and their employer pays a section of the costs for this insurance as an advantage.

Facts About Paul B Insurance Medigap Uncovered

There are four rates of personal insurance coverage strategies within the insurance exchange markets. Bronze strategies have the greatest insurance deductible of all the strategies however the cheapest regular monthly costs.

Gold plans have a much reduced insurance deductible than bronze or silver plans however with a high monthly costs. Platinum plans have the least expensive deductible, so your insurance coverage often pays out really promptly, yet they have the highest possible regular monthly costs.

In enhancement, some exclusive insurance policy firms additionally offer Medicare in the forms of Medicare Benefit, Component D, and Medigap plans. The protection you obtain when you sign up for Medicare depends on what kind of plan you select.

If you require added protection under my website your plan, you must select one that offers all-in-one coverage or add additional insurance strategies. For instance, you might have a strategy that covers your medical care solutions yet calls for extra strategies for oral, vision, and life insurance benefits. Mostly all medical insurance strategies, private or otherwise, have prices such a premium, insurance deductible, copayments, and coinsurance.

The Paul B Insurance Medigap Ideas

There are a range of prices associated with Medicare protection, depending on what kind of plan you select.: A lot of people are qualified for premium-free Component An insurance coverage.

The everyday coinsurance prices for inpatient treatment range from $185. 50 to $742. The month-to-month premium for Component B starts at $148. 50, as well as can be a lot more based upon your earnings. The insurance deductible is $203 for the year. Coinsurance is 20 percent of the Medicare-approved price for services after the deductible has been paid.

These quantities differ based upon the plan you pick. Along with paying for parts An and also find this B, Component D prices differ depending on what kind of medication protection you need, which medicines you're taking, as well as what your premium and deductible amounts consist of. The regular monthly and also annual price for Medigap will depend on what kind of strategy you select.

The most a Medicare Benefit strategy can bill in out-of-pocket expenses is $7,550 in 2021. paul b insurance medigap. Original Medicare (components An as well as B) does not have an out-of-pocket max, suggesting that your clinical costs can promptly add up. Below is an introduction of a few of the standard insurance policy expenses as well as how they function with regard to private insurance policy: A premium is the regular monthly expense of your medical insurance plan.

Paul B Insurance Medigap - Questions

Coinsurance is a portion of the total authorized expense of a service that you are accountable for paying after you've met your deductible. All of these costs depend upon the sort you can try this out of private insurance coverage strategy you select. Analyze your economic circumstance to determine what type of regular monthly and also annual payments you can manage.

Comments on “Not known Facts About Paul B Insurance Medigap”